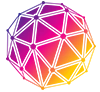

Advantages

We make

everything easier

We understand that you have most likely spent a lot of money on your own tech,

so why not keep what is good, and build an assembly line around it.

InsBio Promo Video

Eliminate Double Entry

So much of shopping insurance is about getting the right information. InsureBio provides a safe

place for insureds to save and share their insurance profile with agents and carriers.

Insurance Stories

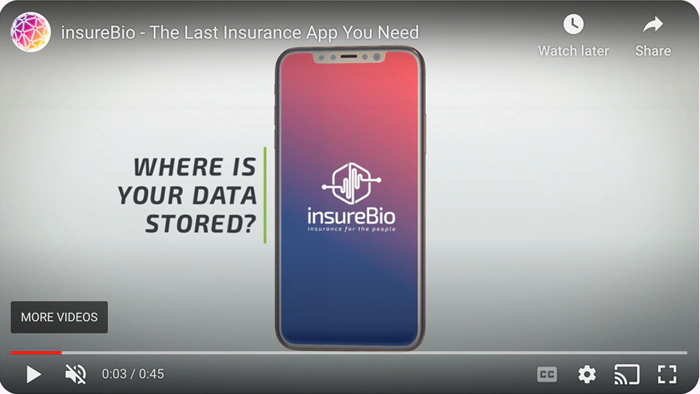

Build any Insurance Purchasing Journey

Use our no code platform to design unlimited flows to gather insurance information. Link surveys to proposal docs with sign and pay to create a customized flow all the way to an insured dashboard.

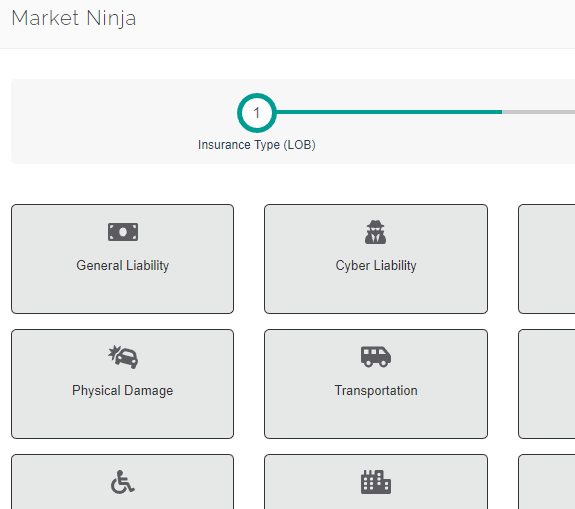

Market Ninja

Marketplace Appetite Engine

Let the ecosystem do the heavy lifting and ensure you are maximizing all your options before sending a decline and augment your current offering with companion products.

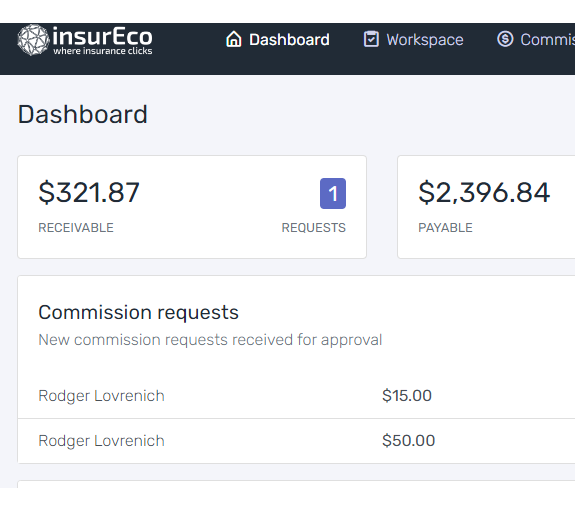

Digital Wallet

Automatically process payments and commissions

Our proprietary Blockchain Ledger System provides the perfect environment to process commissions for every type of insurance transaction instantly.

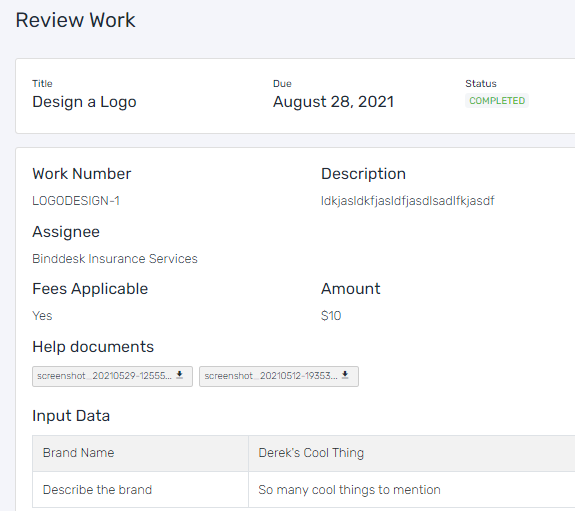

On Demand Workforce

Insurance Work in the Gig Economy

Per task work has been changing the way the world views their jobs and we provide a full suite of useful insurance tasks completed by competent professionals.

Need a little help finding your way?

We understand that deciding on a solution may be a little daunting at times

but never fear because we love to show off our stuff.